Charles Ehredt, CEO Forex Alliance, decodes the loyalty platform mind

Editor’s Be aware:

Charles Ehredt, CEO Forex Alliance shares the second of a two-part collection on the core microservices that allow loyalty advertising and marketing in fashionable enterprise architectures. The second article is titled the Loyalty Guidelines Engine – the module that varies pricing and rewards based mostly on the context of the transaction, enabling the sorts of promotion which can be acquainted from each main loyalty program. You could find Half one right here.

Loyalty guidelines, and the loyalty guidelines engine

This piece on the loyalty guidelines engine might be the second-most vital article I’ll ever write on loyalty advertising and marketing*. It’s the strongest, but below appreciated module (or instrument) in a loyalty advertising and marketing stack of software program.

The loyalty guidelines engine is the module that permits the sorts of promotions which can be acquainted from each main loyalty program. That features issues similar to issuing 2% in factors on the client’s birthday, or double the factors worth in the event that they redeem on distressed stock – and ranging the factors worth for an entire vary of different contextual causes associated to the acquisition. These loyalty guidelines are created so as to enhance buyer attraction and profitability, and the job of enabling them in a loyalty program falls to the principles engine.

In contrast: in a easy cashback scheme, you may supply 4% cashback, or in a easy transactional loyalty program, you simply supply 1% in factors on each buy. This might not require a lot of a guidelines engine – since your program has no variation.

Traditionally, the principles engine module was embedded in a monolithic loyalty system, and the diploma of flexibility in configuring accrual, redemption, or alternate guidelines depended very a lot on the know-how vendor. Such distributors had very fastened views on how clients needs to be engaged and rewarded – no matter how a lot they knew concerning the model’s enterprise, their buyer, or their business.

Manufacturers not should be held hostage by legacy guidelines engines. Even you probably have a guidelines engine for almost all of present buyer interactions, including a cloud-based, microservices-oriented loyalty guidelines engine to your tech stack brings you flexibility. You achieve the flexibility for businesspeople to set further loyalty guidelines, whatever the loyalty platform that you simply’re utilizing.

This brings vital benefits. The flexibility to regulate your loyalty guidelines on this method enormously reduces your dependency on the IT division or distributors and, importantly, lets you have interaction simply with clients throughout many new gross sales channels in a constant method. One may assume that implementing such know-how could be difficult or costly, however a cloud-based loyalty guidelines engine is basically only a skinny layer of know-how that may sit in entrance of the first loyalty system, and might be carried out in days.

An article we revealed almost 4 years in the past, on why providing 1% of the acquisition quantity in factors is sort of at all times improper, has change into far more standard as we speak than when it was first revealed. The crux of the argument is that loyal clients are going to make purchases regardless of what number of factors you supply – so routinely receiving 1% turns into boring for the client, and sure incurs wastage for the model.

It’s exactly the loyalty guidelines engine that permits loyalty entrepreneurs to configure incentives which can be well timed and significant to clients, whereas driving the specified buyer conduct round incomes factors, exchanging factors, or redeeming factors.

The aim of this text is to clarify greatest practices associated to loyalty guidelines, and how one can reap the benefits of the know-how enabling these greatest practices in your loyalty program.

This text on the loyalty guidelines engine is the second in a two-part collection on the core microservices that allow loyalty advertising and marketing in fashionable enterprise architectures. The primary article was on the Loyalty Factors Financial institution – which is the ledger that retains observe of loyalty transactions and is aware of the client’s factors stability.

*The primary-most vital article I’ve ever written on loyalty is this piece on the significance of partnerships. Practically each month, it’s the most-read article in our weblog.

Loyalty guidelines defined

Loyalty guidelines are wanted as a result of completely different buyer actions are roughly useful to the enterprise, and completely different redemptions are roughly worthwhile. Which means that in case you can fluctuate the worth of an motion or worth of a reward, you may optimize your loyalty program for larger buyer engagement and ROI.

These values can change once they happen in a sequence – i.e., ‘motion B’ could also be far more worthwhile if the client takes ‘motion A’ first. So, an efficient framework of loyalty guidelines lets you attribute completely different values to completely different patterns of buyer conduct, and affect fascinating outcomes far more successfully.

When potential purchasers contact me saying they wish to create a brand new loyalty program – however they could not have a substantial amount of expertise, I at all times recommend that the very first thing they do is make a protracted record of all of the behaviors they want clients to carry out. The record must be longer than “Purchase extra stuff”. The concept right here is that the majority companies in all probability need to affect 20-40 particular behaviors that both result in elevated gross sales or larger lifetime worth (LTV).

Examples may embrace:

- be part of the loyalty program

- full purchases

- refer buddies

- put up critiques on-line

- point out the corporate in a constructive method on social media

- full surveys

- make a purchase order on the member’s birthday

- purchase a wider collection of merchandise

- pay on time

- pay with a selected fee methodology

- store on-line

- e-book prematurely

- store throughout my slowest interval of the week (so we might be extra attentive and cut back peak demand)

- spend 20% greater than regular

- strive a brand new product or purchase a selected product (there may very well be dozens of such a rule)

- add a upkeep assure or contract

- return undesirable purchases in essentially the most environment friendly method.

These are simply examples. Elements associated to particular companies, such because the profitability of various services or products, or the price of consuming assets at completely different instances, may result in a for much longer record.

The second step I like to recommend is that for every of the above behaviors, take into consideration what that motion is price to what you are promoting. Is the acquisition price 2% of the incremental income or 10% of the incremental margin? Does referring a buddy or posting on social media enhance the LTV by $25 or $500? Does a subscription to a wellness program imply I’ll probably triple gross sales to that buyer throughout the subsequent 6 months?

Practically all the things can have a financial worth assigned to it. That is how you establish what degree of incentives to supply the client to get them to take that motion. If the incentives are within the type of factors, then you may fairly simply calculate what number of factors to supply for every motion.

The values is perhaps as follows:

| Be a part of the loyalty program | $2.50 |

| Full purchases | 1% of gross sales on low margin items and a couple of%-5% on excessive margin items |

| Refer Pals | $1.00 when referral is made and $5 when the buddy makes their first buy |

| Put up critiques on-line | 50 cents |

| Point out the corporate in a constructive method on social media | 10 cents |

| Full surveys | $1.50 to $3.00 |

| Make a purchase order on the member’s birthday | 25% of incremental margin |

| Purchase a wider collection of merchandise | 3% of additional objects added to basket |

| Pay on time | 1% of bill quantity |

| Pay with a selected fee methodology | 0.5% of basket quantity |

| Add a upkeep assure or contract | 5% of the incremental income |

In case your loyalty guidelines engine is sufficiently versatile and complete, the project of factors on this method might be automated.

You additionally want the liberty to fluctuate these values as wanted. Throughout the record of examples above, few of the behaviors are equally worthwhile each time or on a regular basis – so the quantity supplied ought to fluctuate with the incremental worth created. Every motion is perhaps price roughly on Tuesdays in comparison with Saturdays.

In a points-based program, a base incomes quantity needs to be set so clients earn not less than an anticipated quantity of worth, however you may then introduce bonus rewards to shock or acknowledge clients once they take actions that assist what you are promoting.

As steered, a enterprise might know that if a buyer carries out ‘motion A’, they’re 80% extra prone to perform ‘motion B’. Whereas, if clients don’t perform ‘motion A’, the chance they’ll perform ‘motion B’ is barely 10%. Due to this fact, you may supply fewer factors for ‘motion B’ and allocate the worth related to ‘motion B’ to ‘motion A’ – since you need to get the client on a selected path.

To summarize, the need or precedence to promote particular merchandise or service adjustments over time, so points-based incentives can be utilized to create extra urgency or motivation amongst clients if optimized for the precise context of a possible sale. ‘Context’, as described within the subsequent part, is continually altering, and incentives ought to change as nicely to optimize medium-term ROI.

In a program solely incentivizing transactions, giving a continuing quantity of factors is nothing greater than cashback – and normally much less rewarding than the worth that disloyal clients can get by way of third-party cashback or affiliate schemes.

If a model solely presents 1% in factors throughout all merchandise, clients not solely come to count on the modest profit as routine; in addition they not often change their conduct to earn extra.

Anticipating the context of the transaction

This part will describe the assorted several types of ‘context’ which you will need to seize along with your loyalty guidelines. Then, we clarify the significance of having the ability to draw on various knowledge sources – from elsewhere in your martech stack, and different inputs – so as to fluctuate these guidelines in actual time. That is how one can frequently optimize worth for the client, and ROI for the enterprise.

There are three sorts of context for a transaction which the principles engine ideally wants to have the ability to consider:

- the traits of the client

- the traits of the product/service

- …and the state of affairs during which the transaction takes place.

The purpose right here (pun supposed) is that the ‘context’ of almost each buyer touchpoint is completely different, and it makes little sense to at all times supply precisely the identical incentive (i.e., 1%).

The context of the client

This might usually embrace the client’s procuring conduct, buy historical past, tier standing, demographic knowledge, and psychographic insights.

This knowledge is generally saved within the CRM and used to assemble buyer profiles. The richer the profile, the larger diploma of segmentation that’s potential, and the simpler it’s to foretell the client’s response to a given supply. The loyalty guidelines engine ought to have entry to such perception so as to dynamically adapt the inducement to maximise the chance of driving the specified conduct. With fashionable methods, that knowledge entry is often offered by way of an API (utility programming interface).

For instance, if a buyer has not shopped with you for 6-9 months, you may supply a ‘welcome again’ bonus on high of the conventional incomes price. A buyer who has shopped with you 5 instances this quarter may get a ten% low cost coupon for his or her subsequent buy.

The context of the services or products

This would come with the supply of the stock, its availability at a selected time, the revenue margin on that stock, and any related alternative value. Alternative value consists of the misplaced income if the services or products shouldn’t be bought/booked.

For instance, eating places are sometimes empty on Monday, Tuesday, and Wednesday evenings – however the restaurant nonetheless must have all of the meals ready, workers available, and eating surroundings prepared for company. To optimize the environment friendly amortization of these direct and oblique prices related to serving clients, the restaurant will need to entice extra clients earlier within the week. Due to this fact, they may permit clients to redeem factors/miles with double the conventional worth when spent between Monday and Wednesday. They may additionally supply double factors on higher-margin dishes, when one buyer pays the tab for your entire desk, or if the company dine outdoors of peak instances.

Equally, an airline or resort group may need to supply bonus factors to promote seats or rooms that would go empty, or for direct bookings to keep away from paying third-party commissions. And, retailers or service organizations will nearly at all times have some extra stock they need to liquidate, or idle service capability they need to fill.

The identical applies to different types of ‘distressed stock’ – i.e., stock that will forego income if not bought, or be discounted so as to promote the products. Resort rooms that will go vacant, flowers that can go unhealthy, accessible taxi trip capability, or plumbing providers capability that goes unused all fall on this class.

The context of the state of affairs

This consists of all different components that may affect the client’s predisposition to take an motion at a selected time – such because the climate, the time of day, the day of the month, and the way handy it’s for the client to interact by way of a selected channel or go to a selected retailer. The vast majority of clients probably have extra discretionary earnings accessible proper after they obtain their wage than later within the month, and they’re extra optimistic about their future on sunny days.

Loyalty guidelines might be set to reply to all such triggers so as to maximize the chance of driving a selected buyer motion. Such personalization has remained elusive in most loyalty packages, however with the fitting loyalty guidelines engine, or mixture of guidelines engines, it’s not troublesome to tailor engagement on this method.

The rationale a contemporary, SaaS loyalty guidelines engine is required is that the software program wants to have the ability to settle for knowledge inputs from numerous sources so as to optimize rewards and pricing in response to all of the above contextual components. That is potential with legacy methods, however extra difficult, and normally introduces dependencies on the IT division or distributors.

Fashionable income administration methods, or skilled staff leaders, usually know days, weeks or months prematurely what portion of their capability will probably go unconsumed. This perception needs to be used to tell the place to use incentives, so as to promote extra stock earlier than it turns into distressed. You also needs to have the flexibility to fluctuate reward pricing and factors worth relying on the margin of the products or providers bought, and based mostly on the potential lifetime worth of the precise buyer, since this may mean you can optimize your loyalty funding based mostly on ROI aims.

Essentially the most subtle firms will handle their direct variable advertising and marketing prices proactively to optimize ROI throughout each channel of buyer acquisition or retention. The important thing to contemplating margins is that when margins are excessive, investing extra in buyer acquisition tends to enhance ROI. Most enterprises have already got the flexibility to fluctuate pricing on this method for money transactions. Within the area of loyalty, nonetheless, those that are nonetheless utilizing legacy loyalty methods, and who’re constrained by the legacy guidelines engine, battle to do the identical with their factors worth and reward pricing to extend engagement and drive desired conduct. Cloud-based loyalty guidelines engines overcome such constraints.

Managing the loyalty guidelines engine

I’ll now clarify the performance of the loyalty guidelines engine in additional element, together with the way it interacts with different methods related by API – each in your martech stack, and in your companions’ loyalty platforms.

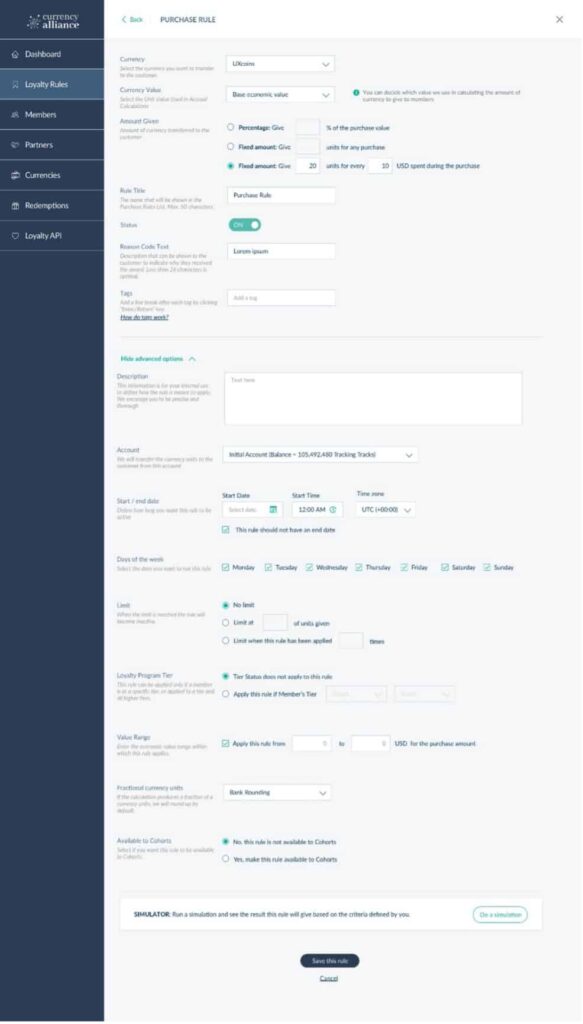

Within the Forex Alliance platform, we’ve guidelines engines for purchases, non-purchase actions, exchanges and redemptions.

Within the screenshot beneath, you may see that a purchase order rule might be related to your personal loyalty factors/miles, or can subject the factors from standard loyalty packages that your clients might choose.

Factors might be issued based mostly on a proportion of the overall buy quantity, a hard and fast quantity of factors per buy, or quite a few factors per Greenback, Euro, or every other fiat foreign money spent.

The rule can have a selected or dynamic reference assigned, so the client is aware of why they earned these factors when taking a look at their transaction historical past.

Factors might be issued from particular accounts so as to observe bills and enhance reporting.

Guidelines can have begin dates and finish dates, and even durations of time throughout particular days when they’re activated – so as to run campaigns or drive conduct to scale back peak demand.

Guidelines will also be outlined with limits, with worth ranges, for particular buyer segments/tiers, or particular person merchandise or classes.

Importantly, guidelines might be layered collectively to drive very particular buyer conduct amongst segments. For instance, a gold tier member that buys a pair of sneakers for over $250 at Macy’s may obtain 5% of the acquisition quantity in factors, whereas a silver tier member may solely get 2% throughout all sorts of sneakers. Or, the shoe producer may fund $20 in bonus factors when sneakers in a selected vary are bought at Macy’s.

Within the case of a buyer who has been inactive 12 months: you may even supply them twice the inducement as an everyday buyer, so as to attempt to reactivate that buyer and construct new habits.

The exercise guidelines are configured with the same display screen, however somewhat than incentivizing purchases, exercise guidelines can encourage different sorts of buyer engagements that ideally enhance lifetime worth. Such actions may embrace providing factors when new members register, giving factors for buyer referrals, incentivizing constructive feedback on social media, taking part in surveys, posting product critiques on-line, or just about anything that creates a deeper relationship with the client and/or helps develop the enterprise.

There are sometimes guidelines which can be solely utilized as soon as a collection of occasions or actions have taken place. These rule processes usually run in batch mode – that may very well be as soon as per day, as soon as monthly, or for every other related time interval. Such guidelines embrace upgrading or downgrading a member’s tier standing relying on the extent of engagement throughout the previous 12 months. Or, an organization may supply a $25 present card if a buyer buys a sure variety of objects throughout 3 separate visits to the shop.

The interface for enterprise customers to configure guidelines may very well be as a set of parameters listed high to backside (as within the earlier screenshot) or there may very well be a graphical consumer interface that lets you set up a sequence of triggers for the rule. What’s vital is that enterprise customers can outline, take a look at, and implement the principles in a matter of minutes with out dependence on the seller or IT division.

What is maybe most vital is that the loyalty guidelines engine can function as a microservice, unbiased of the factors financial institution, CRM, marketing campaign administration, redemption catalog, and customer-facing functions. This enables it to be deployed simply in a broader technical structure to drive buyer engagement throughout any gross sales channels, social media, or different buyer touchpoints.

When a cloud-based loyalty guidelines engine is deployed, all of the logic is saved on the server aspect. Which means that new guidelines might be added, guidelines might be modified, or guidelines might be eliminated by businesspeople by way of a web-based administration portal and no new software program must be rolled out to the POS, web site, apps, or different customer-facing platforms. Eradicating dependency on the IT division or distributors permits the loyalty advertising and marketing staff to check and study at a a lot quicker tempo, and reply instantly to enterprise alternatives as they come up.

A cloud-based microservice guidelines engine can even work in unison with an growing older loyalty program administration system, as a skinny layer of know-how to allow extra versatile operation. As such, the microservices guidelines engine permits buyer touchpoints throughout any channel, calculates what number of factors to subject after which injects the right accrual transaction within the present loyalty system – so all info results in one place.

For all sorts of guidelines: the principles engine ought to ideally have the flexibility to simulate how the rule will operate in a manufacturing surroundings so as to guarantee it was configured accurately. A extra superior guidelines engines may even be capable to predict what variety of clients will have interaction with a promotion and estimate the anticipated ROI.

Loyalty guidelines greatest practices enabled by fashionable know-how

As talked about earlier, most firms with a loyalty administration system have already got a loyalty guidelines engine embedded in that system. Whether it is rigid, then a cloud-based guidelines engine may run in unison with the present loyalty guidelines engine to assist buyer touchpoints throughout new channels.

Moreover, when companions are concerned about issuing your loyalty foreign money to frequent clients, it will likely be a lot simpler for these companions to deploy a cloud-based loyalty guidelines engine than to attempt to use yours. So, even when a brand new guidelines engine shouldn’t be related to your organization as we speak, it might be very related to your companions to allow them to additionally subject your factors, or settle for them as fee from frequent clients.

Should you do select to undertake a contemporary loyalty guidelines engine you’ll shortly uncover that the chances are limitless; an infinite variety of guidelines might be set as much as take almost each variable into consideration. We’ve discovered, nonetheless, that with 20-30 guidelines, most conditions might be coated. Actually, we’ve seen that when greater than 50 guidelines are outlined, the system begins to change into too advanced for the loyalty staff to handle, and clients begin to get confused about what they need to do (and when), so as to profit from the incentives on supply.

Prospects not often assume an excessive amount of about how one can earn or redeem factors. Incentives that appear straightforward and logical to a loyalty marketer who is considering them 20 hours per week can nonetheless appear difficult to a buyer that thinks about your loyalty program only some instances per 12 months – and nearly by no means reads your promotional materials. So, whereas difficult guidelines might be created with ease, our suggestion is to at all times err on the aspect of simplicity.

That may make it manageable for what you are promoting to navigate the thrilling, however presumably daunting prospects {that a} fashionable loyalty guidelines engine permits. Mainly, that suggests the flexibility to incentivize fascinating buyer behaviors throughout any touchpoint, in any advertising and marketing channel or associate surroundings, and with the flexibility to exactly predict and enhance ROI.

With many legacy loyalty methods, you’ll solely be capable to make piecemeal progress in the direction of these aims by making a customized, usually hardcoded integrations to elements of your technical structure. And, you’ll unlikely be capable to use these guidelines throughout methods operated by third-party companions, marketplaces, or social media platforms – the place you need your model to be current (however you don’t have management over the methods).

Introducing adjustments slowly is now merely incompatible with the tempo at which your clients journey between digital environments, with the tempo of innovation by your opponents, and with the ambitions of most fashionable loyalty groups.

The one viable method ahead is to undertake API-first loyalty know-how to present what you are promoting the agility it must succeed.

Chuck wraps up the dialogue describing the place the loyalty business is heading within the subsequent 10 years and explains why an API-first factors financial institution will probably be wanted if manufacturers are to maintain up with the key developments and buyer developments which can be already underway.

You could find the entire article at Forex Alliance right here.