In 2021, worker retention turned a trending matter. Firm’s feared labor shortages, and the media lined the so-called “Nice Resignation.”

Nevertheless, by the second quarter of 2022, inflation pushed inventory costs down and compelled some layoffs from public or venture-capital-funded companies. Labor demand wavered, maybe, barely.

Whatever the ebbs and flows of financial tides, companies should take into account how worker compensation enriches each the corporate’s shareholders and the staff themselves.

Components for Compensation

Specializing in remuneration or financial compensation, excluding advantages and perks, one may argue that there are three important elements or issues.

- Is the compensation loved within the close to time period or long run?

- Is the compensation assured or primarily based on efficiency?

- Can the worker entry the compensation worth?

Some examples will assist to make clear these elements.

Wage or Wages

Remuneration can take the type of an hourly wage or an yearly negotiated wage paid out in common installments after completion of labor.

This type of worker compensation is each assured and near-term.

The worker trusts {that a} paycheck will arrive at a delegated date. And the interval between funds is often solely per week or two.

Quick-term, assured funds give workers monetary stability at floor stage. They’ve a predictable revenue to assist information their cash selections.

Efficiency-based

There are additionally some near-term however performance-based types of worker cost. Maybe, the commonest of those are commissions paid to salespeople, profit-sharing proceeds divided amongst staff, and bonuses for distinctive work and benefit.

These worker funds is likely to be added to a daily paycheck or divvied up quarterly or yearly. This type of compensation could also be thought of near-term and performance-based.

These funds give staff one thing to attempt for and assist the enterprise rally them round set targets.

401(okay) Matching

Firm-sponsored retirement plans are probably the most favorable to workers when the enterprise matches the employee’s contribution.

So if somebody determined to save lots of 7% of every paycheck and place it — pre-tax — in a 401(okay) plan, the employer provides an identical 7%, successfully doubling the funding.

Good 401(okay) matching begins the primary day on the job and is without delay totally assured and long-term. The worker can rely upon the matching however received’t take pleasure in its profit till retirement.

A 401(okay) matching plan ensures that workers can sit up for retirement and belief that they’ll have funds accessible when they’re not working. These applications can also contribute to comparatively higher worker retention.

Pensions

The Hearst Company, a big media enterprise, is understood to have a funded and profitable pension plan for workers that started in 1967.

Within the case of the Hearst pension, workers will obtain a daily cost after retirement in proportion to their peak wage and time with the corporate.

Like 401(okay) plans, pensions present assured long-term compensation.

This type of compensation is probably not as standard with comparatively new companies, however many corporations nonetheless use it, particularly with union staff.

Fairness

When workers share possession in an organization, they obtain long-term and performance-based compensation.

Fairness is the worth an proprietor (shareholder) would obtain if a enterprise will get bought and its money owed paid off.

The long-term nature of fairness signifies that the enterprise (or a portion of it) will get bought earlier than the worker can take pleasure in its worth.

Fairness is performance-based as a result of the corporate should thrive, or at the least survive, earlier than promoting.

Lastly, fairness is an worker favourite as a result of, in some corporations, it might probably make workers fairly wealthy. Think about having obtained fairness in Amazon early on.

Combining Compensation Sorts

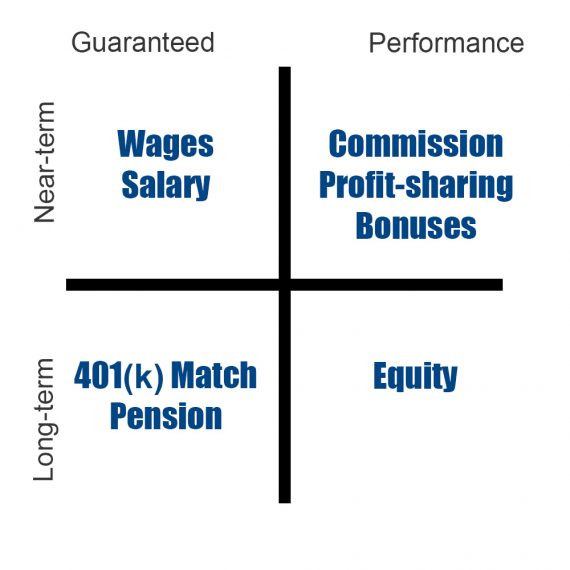

As an organization develops its worker compensation plan, it could be good to incorporate at the least 4 sorts of compensation.

- Close to-term and assured,

- Close to-term and primarily based on efficiency,

- Lengthy-term and assured,

- Lengthy-term and primarily based on efficiency.

An organization may take into account 4 sorts of compensation.

When an organization gives this form of compensation array, it’s serving to its staff discover monetary safety now and within the years to come back.

Availability

A remaining consideration is an worker’s capability to entry worth when wanted.

Listed below are two extra examples that can assist to clarify the benefit of creating wealth accessible to staff.

Entry Wages Now

For the primary instance, take into account a brand new worker at a retail retailer. Paid an hourly wage, this particular person may very well be amongst an organization’s most financially weak staff.

A report from LendingClub and PYMNTS estimated that 67% of American staff lived paycheck to paycheck in January 2022. If this was the case for the retail clerk described above, one thing as widespread as a minor automobile drawback may very well be an emergency.

Too usually, this worker should flip to an virtually usurious pay-day mortgage to outlive, paying annual rates of interest as excessive as 499% in some places.

This single mortgage might influence worker attendance and efficiency because the employee turns to a second job or gigs like Doordash or Uber to cowl the curiosity.

Some companies are serving to resolve this drawback by making a portion of a employee’s paycheck accessible on demand.

For instance, the retail worker described above may be capable of entry one thing like 70% of her every day wages an hour after a shift ends.

On this case, availability may assist a weak worker keep away from high-interest loans.

Entry Fairness

Hourly staff usually are not the one ones dwelling paycheck to paycheck. The identical LendingClub and PYMNTS report estimated that 48% of staff who earned greater than $100,000 per 12 months lived paycheck to paycheck in January 2022.

In line with the report, these workers wouldn’t be capable of cowl an emergency of simply $400.

This report implies that many salaried and highly-compensated staff have both excessive debt or excessive bills, which they could alleviate with the worth saved in fairness.

To this finish, some companies are making it potential for workers to promote their vested choices. These gross sales may take the type of a direct buyback from the corporate or a secondary sale.

For instance, AngelList Enterprise has a liquidity product referred to as Transfers that successfully permits fairness holders to promote shares. A enterprise may schedule this form of sale each 24 months, allowing vested workers to entry the worth of their fairness to repay debt or purchase a home.

Corporations that care about workers will develop compensation plans that finally result in monetary safety.