Many individuals who’ve reached monetary independence have accomplished so investing in actual property. However this aim may appear unattainable to realize should you’re solely wanting on the end result.

In the present day we’ll discuss how one can get began in actual property investing. We’ll present you how one can make investments even should you don’t have a ton of money within the financial institution.

You will want some cash to spend money on actual property. For those who’re critical about investing, it is best to be capable to save up cash in an affordable period of time.

So make a funds that features saving for this function. And assist your aim alongside by chopping non-essential bills.

For the sake of argument, let’s say you’ve received $1,000 saved and also you need to get began with actual property investing. There are few choices you may have a look at to get began.

The best way to Turn into a Actual Property Mogul

Perhaps proudly owning and managing rental properties isn’t interesting to you. Otherwise you don’t need to put a number of money into investing.

Nevertheless, you should still need to develop wealth via actual property investing. In that case, you may think about attempting crowd-funded actual property investing.

Crowd-funded actual property investing is much like peer-to-peer lending. The concept is that you’re a a part of a gaggle of people that pool their cash with different traders.

Then they lend that cash to skilled rental actual property funding property homeowners.

The work in your half with the sort of investing is minimal. Nevertheless, you continue to have the potential to make a critical revenue from actual property investing.

There are a lot of platforms for investing in actual property by way of crowd-funding. I’m going to speak about six of the largest at present.

1. Realty Mogul

Realty Mogul helps you to begin investing in actual property with simply $1,000. The corporate helps you spend money on actual property in another way than a few of the others we’ll talk about right here.

While you make investments with Realty Mogul, you buy shares in one among their LLCs.

The corporate makes use of a distinct LLC to carry the title to the properties invested by way of the primary LLC. There’s a cause they run the enterprise this fashion. It’s so Realty Mogul can provide you added choices for actual property investing.

When you turn out to be a member, you may browse your funding selections. You can too evaluate due diligence supplies for these investments.

When you’ve made an funding determination, you may signal your paperwork on-line. Realty Mogul has a safe system for doing so.

With Realty Mogul you may make investments as an accredited investor. Nevertheless, you may even make investments as a non-accredited investor.

Accredited traders have to satisfy sure standards:

- They should have a single earnings of at the least $200,000 or a joint earnings of at the least $300,000. Be aware that you should have maintained the earnings minimums for the final two years. Additionally, they’re anticipated to proceed within the present yr.

- There’s one other manner you may turn out to be an accredited investor too. You’re thought of accredited if in case you have a web value of at the least $1 million. This quantity can not embrace fairness in your major residence. The $1 million quantity may be solely-owned investments. It may be joint-with-spouse investments too.

As an accredited investor, you may spend money on any of Realty Mogul’s choices. As a non-accredited investor, you will have completely different funding selections.

You’re restricted to investing in one among their two REIT (Actual Property Funding Belief) funds.

What Kinds of Actual Property Does Realty Mogul Make investments In?

Realty Mogul invests in a number of various kinds of properties.

A few of them embrace:

- Single-family investments

- Multi-family properties

- Workplace buildings

- Industrial websites

- And extra

See the Realty Mogul web site for extra info on particular funding choices. They’ve each short-term and long-term funding choices.

You possibly can spend money on six-month investments or as much as 10-years. They’ve many choices relying in your funding objectives.

Study Extra: Realty Mogul Assessment

2. Fundrise

One other well-liked crowd-funding firm is Fundrise. They opened in 2012 have a big collection of investments to select from. Listed here are a few of the specs for investing with Fundrise.

- $500 minimal funding threshold (Starter Plan)

- One % annual administration charge

- Non-accredited traders in addition to accredited traders

- Residential and industrial actual property choices

- Personal market funding advisory and administration providers

3. Groundfloor

Groundfloor focuses on peer-to-peer lending in the true property sector. Buyers lend cash to these seeking to refinance or rehabilitate residential housing.

The minimal greenback quantity you could begin investing with Groundfloor is simply $10. You may be an accredited or non-accredited investor to take a position with Groundfloor.

Groundfloor works to fund loans with grades from A to G. The decrease the grade, the upper danger the mortgage is. Nevertheless, with these larger danger loans comes a chance for the next charge of return.

Groundfloor funds debt investments in actual property versus fairness investments. In different phrases, traders earn a living when loans to debtors are repaid.

There are not any charges for these investing by way of Groundfloor. The corporate’s common charge of return during the last six years is 10%+.

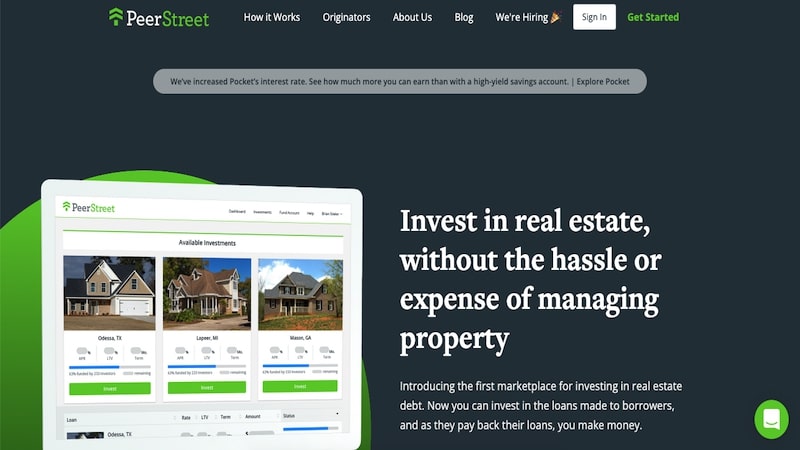

4. PeerStreet

PeerStreet works with trusted non-public lenders everywhere in the U.S. The minimal greenback quantity you could make investments with PeerStreet is $1,000. Know that you could be an accredited investor to take a position with them.

They assess every funding property choice provided to them by the lenders. Evaluation consists of operating properties via their algorithm. They use knowledge science parameters to investigate investments too.

After properties get accepted, they provide them to PeerStreet traders. As an investor, you may select the investments you need to take part in.

Or a second choice is to set your funding standards via the PeerStreet funding software. This function will match you with loans that match standards you set.

Usually, their service charge can be within the vary of 0.25%-1.00%. Nevertheless, you’ll know the charge you’ll pay earlier than you make investments.

Study Extra: PeerStreet Assessment

5. EQUITYMULTIPLE

For those who’ve been in a position to save up greater than $1,000 think about EQUITYMULTIPLE.

Like PeerStreet, they solely settle for accredited traders. Their minimal funding quantity is $5,000, they usually supply funding lengths between 12 and 120 months.

A number of the kinds of properties they spend money on embrace:

- Pupil housing

- Multi-family

- Combined use

- Workplace buildings

So far as charges, EQUITYMULTIPLE expenses a 0.5% service charge, together with one other charge of 10% of all income.

6. HoneyBricks

HoneyBricks is a crowdfunded actual property platform that focuses on industrial actual property.

What’s completely different about HoneyBricks is that you’re investing in skilled managed, high-quality tokenized actual property.

Every funding is tokenized on the Ethereum blockchain, permitting for fractional possession and distribution of tokens on to your digital pockets.

You need to use U.S. {dollars} to take a position or make investments instantly out of your crypto pockets. Returns are deposited into your linked crypto pockets(s).

The corporate focuses on industrial actual property in sturdy progress areas in 15 of essentially the most populated cities within the U.S.

The minimal to take a position is $1,000, though some investments might have larger minimums.

Solely accredited traders can use HoneyBricks as of this time.

There’s a 12-month minimal maintain interval in your shares as outlined by U.S. Securities regulation, though you may redeem your shares again to HoneyBricks at any time.

HoneyBricks does cost administration charges, that are outlined within the Phrases and Circumstances report you’ll obtain once you enroll.

Extra About Crowdfunded Actual Property

Buyers who make investments their cash in crowdfunded actual property investments have a novel likelihood. They will spend money on a small piece of an actual property funding or the complete funding.

Statistics charts on crowd-funded websites observe an funding’s earnings historical past info. They usually usually present traders with year-end tax info as nicely.

Additionally, traders can handle their investments on-line.

The principle attraction of crowdfunded actual property investing is that it’s simpler for the investor.

For example, another person does the work of discovering the property, getting a mortgage mortgage on the property, and so on.

And traders don’t have to fret about screening tenants, managing tenants and the property.

Additionally, the greenback quantity you’ve invested is minimal. Moreover, another person is answerable for the property mortgage or loans you spend money on.

This implies you don’t have to fret in regards to the added debt in your credit score report.

Above all, your workload is minimal, but the potential for revenue can nonetheless exist.

Crowdfunding Has Modified Issues

Earlier than the world of crowdfunding, solely these with connections may spend money on non-public actual property offers. The Securities Act of 1933 established that rule.

This act dominated that personal securities couldn’t market investments akin to actual property investments publicly.

You needed to be “within the know” should you needed to fund the true property ventures of rich actual property moguls. And the choose group of people that had entry to those offers usually needed to make investments huge quantities of money.

At occasions, they needed to spend money on the six-figure vary for the privilege of investing in non-public actual property ventures.

However crowdfunded actual property investing has modified that. It permits traders of all completely different backgrounds to get in on ground-floor investing offers.

Now it doesn’t matter who you understand, whether or not you’re a first-time or seasoned actual property investor. You can begin with as little as $1,000 or much less, and begin making passive earnings in actual property.

Principally, crowdfunded actual property investing has leveled the enjoying subject. No extra closing the door on actual property investing to everybody however the super-rich.

There are tons of of crowd-funded actual property investing firms on the market. Listed here are some suggestions for selecting crowdfunding actual property properly.

Do Your Analysis

It’s necessary to analysis the crowdfunding firms you’re contemplating. Make sure you ask questions like these:

- How lengthy have they been in enterprise?

- What’s the expertise of their management group?

- What are their tips for debtors? For traders?

- What’s the minimal funding quantity?

- What charges do the crowdfunding firms cost?

- Do traders have entry to historic returns?

The extra clear the crowdfunding firm is, the higher. For that reason, you’ll have extra info with which to make an funding determination.

Perceive What You’re Getting Into

It’s necessary to grasp how the method works with crowdfunded actual property investing. Every firm has completely different strategies for calculating and distributing investor returns.

There are typically two kinds of crowdfunding investments in the case of actual property. They’re debt investments and fairness investments.

With debt investments, you earn your cash as the true property borrower pays again their mortgage. With fairness investments, your return depends upon the efficiency of the rental property and its earnings.

For example, let’s say you spend money on industrial actual property property. This property can home a number of tenants.

On this case, you because the investor make more cash if all of these areas get rented out. If the industrial constructing sits half empty for some time, you earn decrease returns.

Do your analysis on every crowdfunded actual property firm. Study which kinds of investments they fund. Then select the kind of funding that matches your danger tolerance and funding schooling stage.

The extra you educate your self, the higher you’ll perceive the dangers and advantages. This can enable you to to make smarter investing selections.

Conventional Actual Property Investing

An alternative choice to think about is conventional actual property investing. In different phrases, you purchase rental properties and lease them out to others. Conventional actual property investing is a good choice for rising wealth.

Nevertheless, there are some downsides with conventional actual property investing. Contemplate these downsides earlier than you go that route.

First, conventional actual property investing requires heavy time enter. Chances are you’ll want to take a look at dozens of homes earlier than you discover the appropriate one for rental functions.

Then after you make your buy, you’ll spend time doing different work. You’ll be readying the home for tenants and trying to find tenants. Additionally, you’ll be managing and sustaining the property.

Second, let’s say you’re beginning with a minimal amount of cash down. In that case, you’ll must first buy the house as an owner-occupied house.

Then you definately’ll should dwell there for at the least twelve months earlier than renting the home out. For that is the rule with most lenders for buying an owner-occupied house with a minimal quantity down.

Carrying a Mortgage

There’s one other added job with conventional actual property investing. And that’s that you just maintain the mortgage mortgage on the property.

Let’s say you’ve saved $5,000. And you set 5 or so % down (on a $100,000 buy in case your money obtainable is $5,000).

Then you’re holding a mortgage with little or no safeguard between you and a housing market downturn.

I’m not in opposition to conventional actual property investing. Nevertheless, once you’re getting in with a small amount of money to start out with its important to pay attention to the dangers.

There Are Dangers When Investing in Actual Property

Whether or not it’s conventional or crowdfunded actual property investing, there are dangers concerned.

For example, conventional actual property traders could also be unable to lease a property in a foul space of city. Or they stands out as the recipient of a housing market crash.

Plus, they could should do huge repairs if a tenant damages the house.

And when investing in crowdfunded actual property investments, you’re nonetheless in danger. The investments you select even have the potential to lose cash.

It’s necessary to coach your self on the professionals and cons of each kinds of actual property investing. Do that earlier than selecting which kind of actual property funding is finest for you.

Your danger consolation stage is an element as nicely. With crowdfunded actual property investing, you don’t carry the complete burden of rental property possession. As a substitute, you’re sharing the chance with a number of different traders.

Both manner, the potential for rising wealth is a actuality. It’s doable for each conventional and crowd-funded investing. Crowdfunded actual property investing has opened the door for a lot of traders.

With practically any amount of money, you may develop your web value by way of actual property investing.

Abstract

In short, folks will all the time want a spot to dwell. And corporations will all the time must conduct their companies in places of work. These information make actual property investing in any type a wise funding to think about.

So even should you’re solely in a position to begin with a small amount of money, take into consideration actual property investing. By doing so, you may make your strategy to “actual property mogul.”

The knowledge contained herein neither constitutes a proposal for nor a solicitation of curiosity in any securities providing. Nevertheless, if a sign of curiosity is supplied, it might be withdrawn or revoked, with out obligation or dedication of any type previous to being accepted following the qualification or effectiveness of the relevant providing doc, and any supply, solicitation or sale of any securities can be made solely by the use of an providing round, non-public placement memorandum, or prospectus.

No cash or different consideration is hereby being solicited, and won’t be accepted with out such potential investor having been supplied the relevant providing doc. Becoming a member of the Fundrise Platform neither constitutes a sign of curiosity in any providing nor includes any obligation or dedication of any type.