Anybody not dwelling beneath a rock is aware of that subscription companies are big as of late:

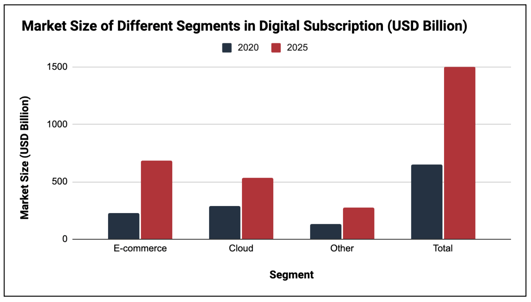

- The worldwide subscription market is projected to succeed in $1.5T subsequent yr

- Three in 4 D2C firms have some type of subscription providing

- The mixed market cap of all digital subscription firms has reached $14T (with new entrants nonetheless leaping in)

Supply: UBS

However making a buck isn’t as simple anymore, particularly since shoppers at this time paying $1k per yr on subscriptions appear to be outgrowing this mannequin.

If there’s ever a “subscription apocalypse” – like everybody buying and selling of their subs for a Tesla – the individual it’s best to name for assistance is Daniel Layfield.

Dan led development at Codecademy from $10m to $50m ARR. He’s now sharing battle-tested development knowledge at Subscription Index.

In response to Dan, there are three inquiries to ponder about earlier than you start thinking about a subscription enterprise.

First, A Refresher

Subscription Pricing

Subscription pricing is a pricing mannequin that enables prospects to subscribe to providers or buy merchandise for a particular period of time on a recurring foundation at a set value level” typically in month-to-month or annual intervals.

What we’re discussing right here don’t embrace enterprise contracts, the place you receives a commission tens of millions a yr by massive purchasers. We’re referring to companies that make most of their income through smaller, recurring funds from a big portion of customers.

Now onto the questions:

1. How Lengthy Would A Typical Person Want My Answer?

For somebody to pay for one thing repeatedly, they should assume that they’ll get worth from it throughout a number of makes use of.

A one-off buy like a sandwich is a non-starter (except you are launching a wildly area of interest “thriller sandwich of the month” membership…). However water equipped to your own home is a superb match, since you’ll want it eternally.

The perfect subscription enterprise mannequin has:

So don’t get excited by the promise of recurring income simply but.

Do your analysis, discuss to potential customers, and consider how lengthy they’ll possible want your resolution. That’ll assist you to estimate the ceiling for buyer lifetime worth (LTV).

Supply: Dan Layfield

2. The place Do I Have The Most Alternative?

In idea, you’d need to shoot for the very best income potential, or the highest proper quadrant on Dan’s graph.

However there are already huge, entrenched gamers working in these areas, making them troublesome to compete in. Disrupting your native utilities firm? Not a simple feat.

For newer, smaller firms, Dan sees essentially the most alternative within the medium-length use circumstances, comparable to:

- SaaS or specialised providers

- Job coaching or ability growth

- Courting

- Getting in form

These wants typically take a number of months to a couple years to finish, supplying you with a pleasant runway of recurring income.

However your use circumstances ought to be not less than three months lengthy – shorter than that, you would possibly as properly cost for all the worth upfront. You’ll be combating churn HARD the entire time.

3. Can I Afford To Be Affected person?

In the event you have a look at an inventory of the “quickest” rising SaaS firms, in addition to having a terrific product and nice go-to-market expertise, they’re normally B2B sales-led merchandise.

Ramp grew 400% in a yr as a result of they might promote longer-term offers and accumulate extra cash upfront.

In the meantime, most client subscription companies must grind out extra linear enlargement over time – even the quickest rising gamers like Spotify scale their subscriber base in a gradual (but constant) method.

Supply: Statista

This implies it’s essential embrace a for much longer runway and a extra affected person strategy to constructing your small business.

In the event you’re bootstrapping, hold prices tightly managed since it might be some time earlier than you see materials income traction.

In the event you’re venture-backed, rent as lean a staff as potential. Keep away from the temptation to over-staff – you understand how that ends.

So why keep it up if it is such a sluggish grind?

As a result of subscription pricing additionally gives its distinctive set of perks.

The Advantages of Subscription Pricing

Recurring Money Circulate

Subscriptions gives you predictable money flows, which eases the stress on buyer acquisition. You received’t must always get new prospects to make cash.

In the event you can retain customers for lengthy durations of time, you possibly can compound into a extremely giant enterprise as a result of every month extra recurring customers get added to the consumer base.

Excessive Valuations

The recurring money circulation are inclined to get you very excessive valuations, Dan says.

- Codecademy was making round $50m per yr in 2021, and was purchased for $525m later that yr, getting nearly a 10x a number of.

- Amazon purchased PillPack for $1B in 2018. The startup was reportedly making round $100m in income the yr earlier than, getting a 9x-10x a number of.

Traders and personal fairness firms love subscription companies due to the secure money circulation – not like a enterprise that’s depending on new gross sales every month to generate income.

And if you will get churn decrease than your natural consumer sign-ups, you could have a enterprise that may simply develop from momentum.

Diversified Income Base

Since you could have a whole lot of small transactions that make up your income base, your small business is extra sturdy throughout the long run.

This differs from enterprise B2B firms, which could earn half of their income from three giant purchasers. If these purchasers go away, they’re in deep trouble. Due to this, consumer-facing subscription companies can climate unhealthy economies comparatively properly.