Think about you run a brick-and-mortar retailer and a buyer comes into the store and needs to pay for a product. However, they don’t have any money and wish to pay with a bank card. To simply accept the shopper’s cost, you’ll want a cost gateway, or level of sale (POS) terminal to acquire cost data by card or cell system.

When you can’t settle for their card, you would possibly lose them as a buyer to the competing retailer subsequent door.

Need to launch an e-commerce retailer as effectively? You’ll additionally want a cost gateway to simply accept clients’ funds.

A web based cost gateway takes the type of a checkout portal like HubSpot’s One Web page Pay the place clients can enter bank card or cost gateway service supplier data. Standard cost gateway service suppliers embrace PayPal and Apple Pay.

Finally, any enterprise that desires to simply accept bank cards and on-line funds wants a cost gateway.

On this information, we cowl every part you should find out about cost gateways:

What’s a cost gateway?

A cost gateway transfers a buyer’s cost data to a vendor’s checking account, making certain the shopper has sufficient funds to make a cost.

Fee gateways are sometimes confused for cost processors, however there’s a distinction. A cost gateway is the know-how sellers use to simply accept funds, transmitting the shopper’s cost data to the vendor to get the vendor paid. A cost processor transfers transaction information, dealing with the trade of data between the shopper and the vendor.

How a Fee Gateway Works

A cost gateway performs an integral position within the general cost processing system. It’s the front-end know-how that sends the shopper’s cost data to the vendor’s buying financial institution.

As know-how evolves, so do cost gateways. Up to now, POS terminals used magnetic strips and the vendor collected paper signatures from clients. Immediately, chip applied sciences and contactless purchases like Apple Pay expedite the cost gateway course of.

Fee Gateway Examples

Under is a fast record of a number of the cost gateways you would possibly work together with every day.

- PayPal: PayPal is among the hottest redirect cost gateways that’s geared up with a strong anti-fraud workforce. With forex and cart compatibility, retailers additionally select PayPal for its versatility.

- Apple Pay: Apple Pay funds are processed by a suitable bank card. Many brick-and-mortar retailers use Apple Pay for its ease of use.

- Sq.: It is a well-liked cost gateway for cell and in-person transactions.

- Stripe: Retailers select Stripe for straightforward setup and customization choices. Stripe additionally boasts techniques that simplify the checkout course of, like one-click checkouts.

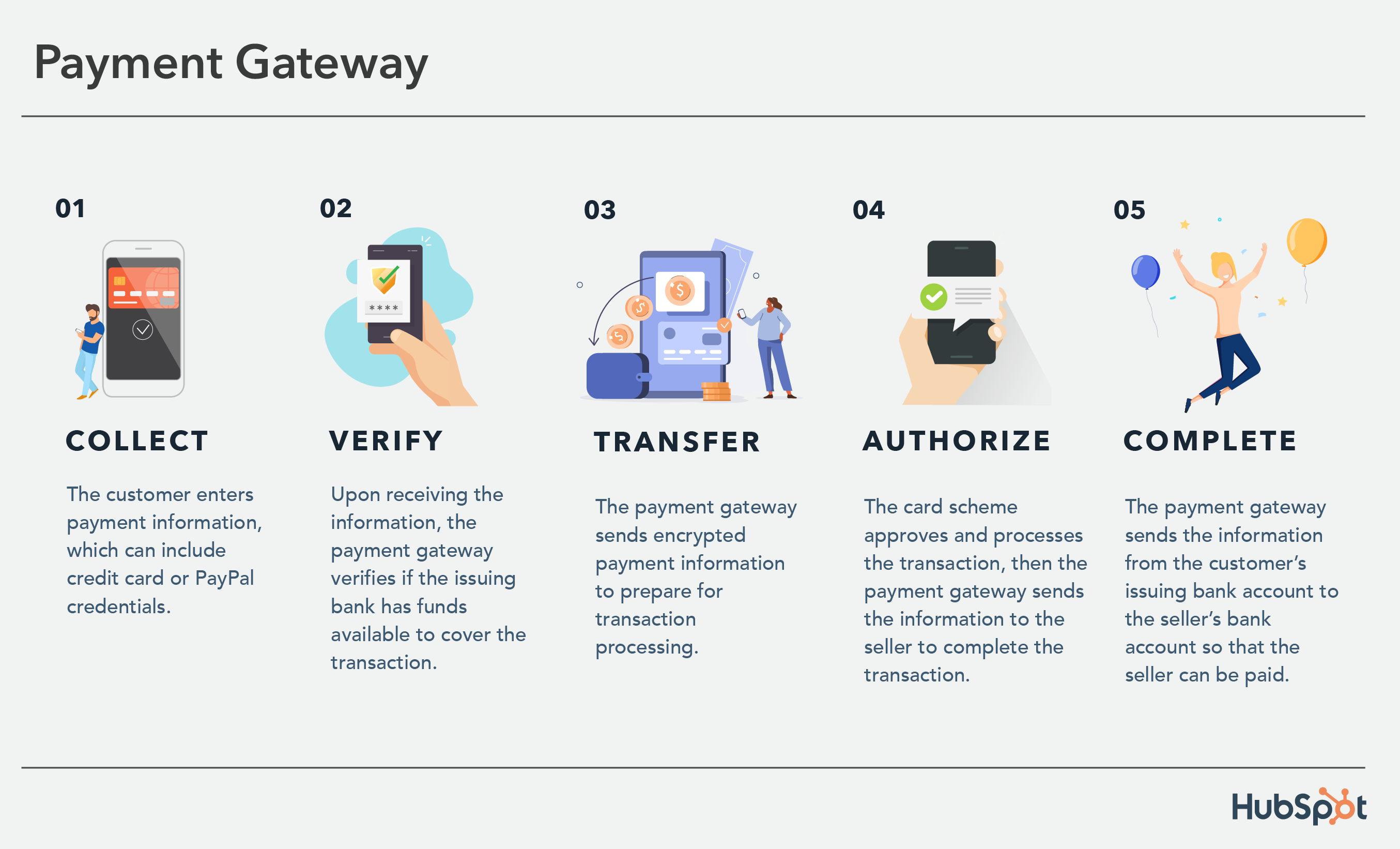

The know-how powering a cost gateway may appear sophisticated, however a cost gateway transfers the shopper’s cost to the vendor’s checking account inside seconds. The graphic under breaks down the steps concerned.

Fee Gateway Steps

Accumulate

The client enters cost data, which may embrace bank card or PayPal credentials.

Confirm

Upon receiving the data, the cost gateway verifies if the issuing financial institution has funds obtainable to cowl the transaction.

Switch

The cost gateway sends encrypted cost data to organize for transaction processing.

Authorize

The cardboard scheme approves and processes the transaction, then the cost gateway sends the data to the vendor to finish the transaction.

Full

The cost gateway sends the data from the shopper’s issuing checking account to the vendor’s checking account in order that the vendor might be paid.

Who’s concerned in a cost gateway?

There are a number of actors concerned in a cost gateway: vendor, cardholder, issuing financial institution, card scheme, and buying financial institution. On this part, we’ll break down the roles they play.

Vendor

The vendor, or service provider, is the entity that’s paid for promoting a services or products. The vendor accepts the cost from the cardholder or buyer.

Cardholder

The cardholder is the shopper buying a services or products from the vendor. Purchases can occur in-store or on-line.

Issuing Financial institution

The issuing financial institution is the financial institution that’s answerable for the shopper’s account.

Card Scheme

A card scheme is the bank card firm that manages the bank card. Examples embrace Uncover and Visa.

Buying Financial institution

The buying financial institution is the financial institution that’s answerable for the vendor’s account. The vendor’s account receives cash from the shopper’s account by a cost gateway switch.

Kinds of Fee Gateways

There are a number of several types of cost gateways: redirects, front-end checkout, and on-site. Every technique has distinctive advantages and challenges.

Redirects

A redirect cost gateway takes the shopper to a cost web page to complete the transaction. PayPal is a well-liked instance.

Supply: PayPal

When the vendor makes use of a redirect cost gateway like PayPal, PayPal handles the transaction processing, which may alleviate the burden on the vendor’s finish. Nevertheless, it’s an additional step for the shopper to go to a distinct cost web page.

Entrance-end checkout

Supply: Stripe

With a front-end checkout, the checkout happens on the vendor’s website, however the cost processing takes place within the backend. Stripe is an instance of a front-end checkout cost gateway.

On-site

An on-site cost gateway handles the complete checkout course of on the vendor’s website. Due to the complexity, this technique is most well-liked by giant companies. With this technique, the vendor has extra management over the method, but in addition extra duty in sustaining the front-end and backend.

Often Requested Questions About Fee Gateways

Right here, we reply a number of the most typical questions retailers could have about cost gateways.

What’s the distinction between a cost gateway and a cost processor?

A cost gateway is the know-how that transfers a buyer’s cost data to the vendor so the vendor can receives a commission. A cost processor strikes the transaction by the processing community and sends the billing assertion.

Why use a cost gateway?

Sellers can save time through the use of a cost gateway since they don’t need to manually enter buyer data; a cost gateway automates that course of. This frees up time for the vendor to give attention to their enterprise as a substitute of duties that may be dealt with with know-how.

When a buyer makes a purchase order, a cost gateway encrypts delicate data like bank card funds, making certain a safe transaction. A cost gateway additionally provides clients extra cost choices: extra cost choices means a bigger buyer base.

How can a vendor accommodate clients’ totally different cost choices?

Stacking cost gateways means incorporating a number of cost gateways in your website to accommodate totally different buyer wants.

A Baymard institute examine discovered that 9 p.c of shoppers abandon their cart throughout checkout as a result of there should not sufficient cost choices. Moreover, Almost 30 p.c of People don’t have a bank card, in accordance with a Nilson report. By together with each bank card funds and digital cost choices like PayPal, Apple Pay, and Google Pay, clients have extra cost choices.

What makes a cost gateway safe?

A cost gateway has to adjust to Fee Card Business Information Safety Requirements. One among these requirements is encryption: a cost gateway makes use of their very own code to encrypt buyer information.

Encryption means concealing the info in order that it’s unreadable to entities aside from the cost gateway. Tokenization protects clients’ bank card data by changing their information with a novel identifier known as a token. The token securely shops information the shopper must make a future buy.

How a lot does it value to arrange a cost gateway?

Anticipate to pay a setup payment, month-to-month payment, and small transaction payment. Costs fluctuate relying on the cost gateway.

Fee gateways are important for companies.

It doesn’t matter what trade you are in, or how large or small what you are promoting is, having a cost gateway is a essential a part of the cost processing system.

The seamlessness of a cost gateway that automates processes, secures delicate buyer data, and gives clients with extra cost choices can enhance buyer satisfaction and even profit your backside line.

Fortunately, it isn’t too sophisticated to arrange a fail-proof cost gateway. To study extra about HubSpot’s new B2B Funds options, click on the banner under.