“Ought to I purchase a brand new automobile?”

For those who requested nearly each private finance pundit that query, they’ll offer you a bunch of the reason why you can purchase used as a substitute.

Our founder, private finance professional Ramit Sethi, disagrees.

Used vehicles can be a great way to go. However to use a broad rule that “used is the perfect” is short-sighted. Actually, Ramit thinks there are numerous extra the reason why individuals should purchase a brand new automobile than used.

Ought to I purchase a brand new automobile or used automobile in the long term?

It can rely upon the kind of automobile you purchase, and the situation you purchase it in. That mentioned, in the event you’re going to purchase a good make that’s in actually good condition, you may land your self a cut price.

Nonetheless, right here’s the rub. Are you aware sufficient about vehicles to know whether or not you’re shopping for a gap in your pocket? Even when it’s a great make, you may’t make sure that the earlier proprietor didn’t do donuts within the Greatest Purchase car parking zone after darkish.

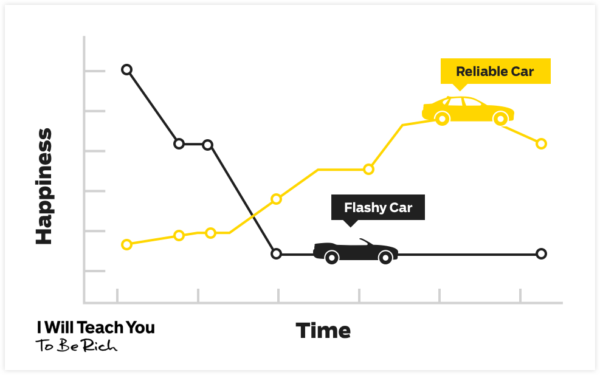

In the long term, a brand new automobile may find yourself costing much less as a result of there’s much less to repair. All automobile components have a life span and finally, you’re going to have a look at changing issues. Costly issues.

A good way to pay for these bills is with a aspect hustle or your personal enterprise. Earnable provides you all the precise methods, frameworks, hands-on ways, real-world examples, mindsets, done-for-you templates, word-for-word scripts, and hard-won breakthroughs to start out and develop your personal enterprise. Click on right here to study extra.

Is Shopping for a New Automobile Price It

New vehicles get a foul rap from monetary pundits as a result of the idea is that you just’re going to spend your cash on one thing you may’t afford, doesn’t make sense, and worse, is excessive.

For those who’re going to try this, you may find yourself resenting the acquisition. Even worse, it’d land you in monetary hassle.

A brand new automobile is cheaper when it prices you much less in installments and upkeep than a second-hand automobile. However it’s not simply in regards to the precise cash spent. It’s additionally about your personal emotional wellbeing realizing your automobile isn’t going to overheat and flake out in visitors each Monday morning.

For those who’re asking, “Ought to I purchase a brand new automobile?”, the reply is sure if it meets your wants and matches inside your finances.

Professionals of shopping for a brand new automobile

- The most effective causes to purchase a brand new automobile is, every thing’s new, together with the components. Even when one thing goes unsuitable, most producers have a guaranty for the primary yr or two.

- Insurance coverage is cheaper. It is because there’s much less threat of mechanical failure. However it’s not a assure. When shopping for a brand new automobile, examine to see whether or not it’s high-risk in a roundabout way. Go for vehicles which can be within the low-risk class to learn from an insurance coverage drop.

- Peace of thoughts. What’s worse than planning a visit away for the weekend and spending half the week fixing the automobile to get it prepared? Or having your mechanic on velocity dial as a substitute of your partner? A brand new automobile shouldn’t offer you gears, and when it does, there’s the producer’s guarantee to fall again on. The purpose is, you recognize that in the event you fill it with gasoline and carry out routine upkeep, the automobile ought to get you from level A to level B. Are you able to say that in regards to the oldie-but-cheapie being punted by the second-hand automobile salesman?

- Resale worth. That is the place you’re taking out your Kelley Blue Guide and examine the automobile you’re seeking to purchase. For those who occur to decide on the appropriate make, you may find yourself with a great deal. For example, Ramit, our founder, has a pal who purchased an Acura Integra for $20,000. She drove it for seven years and managed to promote it for 50% of the acquisition worth. She acquired an unbelievable worth in the long term along with her new automobile buy.

- Gas financial system. Let’s face it, know-how has come a great distance these previous couple of years and on the subject of vehicles, gasoline effectivity is a sizzling subject. Spending a couple of additional {dollars} on the gasoline pump provides up.

- The atmosphere, guys. There’s something to be mentioned for driving a automobile you recognize passes all these emissions exams. You don’t essentially should make the leap to a Prius until you need to. Automobiles constructed after the nineties are constructed with the Clear Air Act rules. Nonetheless, yearly the benchmark drops to ensure that cities and nations to satisfy emissions targets. Because of this your gas-guzzling truck from the sixties might must bear a couple of modifications to satisfy trendy emissions requirements.

- That new automobile scent. It’s evocative and attractive and it doesn’t matter whether or not you go for the Toyota or the Dodge. New automobile scent is new automobile scent.

Cons of shopping for a brand new automobile

- That downpayment. Automobile loans typically require a ten% to twenty% downpayment and in the event you’re taking a look at a $25,000 automobile, the downpayment is kind of steep.

- It’s costly up entrance. Irrespective of which approach you slice it, a brand new automobile is dear. For those who occur to be a household of six, an entry-level Chevrolet Spark simply gained’t minimize it. It’s good to goal for the $20,000-mark to discover a automobile that fits your wants and meaning an affordability examine.

- It may not be reasonably priced. Let’s do the mathematics and for that, we’ve got the 20/4/10 rule. It really works like this:

- 20% downpayment: Not having the ability to put down a 20% downpayment in your automobile might imply that you just’re not prepared for it but. It’s additionally price noting that this financial savings must be separate out of your emergency financial savings.

- 4-year time period or much less: The longer you pay in your automobile, the extra curiosity you pay in the long term. Attempt to goal for a time period that’s 4 years or much less.

- 10% or much less of your gross month-to-month revenue: If the automobile installment and all the opposite car-related prices are greater than 10% of your gross month-to-month revenue, you is likely to be biting off greater than you may chew.

- The bells and whistles. While you purchase a automobile straight from the dealership, anticipate to be offered to. That salesman goes to need to hit his gross sales goal which suggests tremendous fancy rims, that spectacular sound system, the works. Do your homework beforehand and know what you need earlier than you even stroll in there. Electrical home windows, satellite tv for pc radio, leather-based seats, no matter you take into account the naked minimums you’re keen to fork out for.

- It messes along with your Wealthy Life. The minute you are feeling pressured into shopping for a brand new automobile for causes aside from essentially the most sensible, it is likely to be time to re-evaluate. Is it societal stress, will it take you longer to dwell your Wealthy Life? If the reply is sure, get outta Dodge (the dealership).

While you’re higher off shopping for used

Generally a brand new automobile isn’t price it within the lengthy haul. Search for a licensed pre-owned automobile that ensures you’re getting what you’re paying for.

Professionals of shopping for a used automobile

- It’s cheaper initially. For those who want small installments and a low downpayment, then a second-hand automobile is a greater possibility.

- It’s a good selection for the brief time period. For those who’re seeking to change your automobile in a couple of years and easily want a automobile to fill the hole, a second-hand automobile is likely to be a great match. Remember to put cash apart for companies and upkeep so you retain it in good operating situation till you’re able to promote.

- You’ve purchased a automobile that holds its worth. There are some vehicles that merely maintain their worth nicely and even in the event you purchase it second-hand, promoting it a couple of years later gained’t be an amazing loss.

- You don’t qualify for finance. This may very well be on account of affordability or a low credit score rating. A used automobile is right in the event you’re seeking to purchase a automobile in money.

Cons of shopping for a used automobile

- No lemon safety. With a brand new automobile, when life arms you a lemon you may hand it again to the vendor. Used vehicles might have plenty of issues unsuitable and even whenever you supply from a good vendor, there may very well be underlying points. In case your used experience doesn’t include a guaranty, you’ll be caught with it. Spend a bit of additional and have the automobile appeared over by an trade skilled.

- Gas effectivity. For those who’re going for the automobile that made all the ladies loopy in highschool, likelihood is you’re additionally spending a ton on gasoline. Trendy engines take pleasure in modifications that make them run higher on much less gasoline.

- Financability. Not everybody will need to finance your 11-year-old beater. And once they do, they could add on some curiosity and a bigger downpayment to scale back their threat.

- Insurability. While you assume automobile insurance coverage, assume threat. The older the automobile, the riskier it turns into to make sure it as a result of its reliability begins declining. What meaning for you as an proprietor is elevated insurance coverage premiums.

- Unreliability. Your used automobile is much extra probably to provide you up, allow you to down, and desert you than a brand new one.

How to economize on a automobile

In an effort to be sure that shopping for a brand new automobile is price it, don’t simply stroll right into a dealership and buy the primary automobile that catches your fancy. Do your analysis to verify future you can be happy with your buy.

Choose a great automobile (and hold it for the lengthy haul)

Shopping for a automobile is a severe dedication. Whereas it might be a depreciating asset, which signifies that the automobile worth decreases over time, it ought to nonetheless make sense in the long term. A superb automobile could have extra than simply nice horsepower and high velocity. Nice attributes to look out for embody:

- Serviceability. Do analysis on the supply of components and the price of companies. For example, automobile makers resembling Nissan and Toyota is likely to be imported, however they’re simple to service and the components are cost-effective.

- Fame. What do drivers say about their vehicles? Do they take pleasure in good scores on automotive blogs? Extra importantly, take a look at the security ranking. If it’s beneath a 4 out of 5, you may need to maintain off, particularly if you wish to hold it for the long run.

- Auto insurance coverage price. There are some autos which have the next insurance coverage fee purely as a result of they carry an even bigger threat, resembling theft or mechanical points. Discover out which these are and look the opposite approach.

- Resale worth. Search for the vehicles which can be the preferred on the licensed pre-owned flooring. These vehicles retain their fame and sellers are keen to place their stamp on it.

Negotiate with sellers

First off, know when to purchase a brand new automobile and when is the proper time to go to a automobile dealership. Attempt in the direction of the tip of the yr when everybody’s making an attempt to shut these closing gross sales for his or her year-end commissions. However that’s not the one purpose you need to go in the direction of the tip of the yr.

Sellers may even need to do away with the inventory for that yr to make approach for the shiny new inventory. Because of this in the event you purchase in November 2021, you’ll drive a 2021 mannequin. Nonetheless, sellers begin getting their 2022 inventory in December which suggests you may register your automobile as a 2022 mannequin. By choosing the 2021 mannequin, you may negotiate a cheaper price.

Stand agency on this, in the event you really feel just like the vendor is making an attempt to strongarm you, stroll away. There are many sellers making an attempt to do away with their inventory, even when it’s essential drive throughout city to a different dealership.

Get an awesome rate of interest

Earlier than you even head out to the dealership it’s best to know what your credit score rating is. A superb credit score rating is a good bargaining chip for a great rate of interest. While you really feel like the speed supplied isn’t pretty much as good as it may be, then it’s time to buy round.

A distinction of two% could make an amazing distinction.

For example, a $20,000 mortgage over a interval of 48 months at a fee of two.39% will price round $438 per 30 days. At a fee of 4.39%, that installment jumps to $456. That’s $864 over the mortgage interval.

Your credit score rating is on the coronary heart of securing the bottom rate of interest attainable.

Get a simple mortgage

Don’t trouble with shiny finance agreements that depart you confused and presumably out of pocket. The only possibility is usually the perfect. A number of the extra widespread choices are:

- Secured auto mortgage (easiest). This mortgage sort protects the lender by permitting them to safe the asset, which is finished by way of a lien over the automobile. That signifies that the lender can repossess your automobile in the event you fall behind on funds. That is the best mortgage sort and works out cheaper as a result of the lowered threat often means a lowered rate of interest.

- Unsecured auto mortgage. That is very similar to a private mortgage and since there’s the next threat for the lender, tends to be a bit costlier.

- Lease. This can be a no-go for anybody who desires to maintain their automobile for the lengthy haul. A lease is likely to be cheaper on installments, however to personal the automobile on the finish of the time period, it’s essential pay a lump sum to imagine possession. This isn’t for everybody and might be complicated and dear.

Take excellent care of your automobile

Take out a service plan and ensure to maintain these companies updated. The higher you preserve your automobile, the much less probably you’re to run into costly, avoidable points resembling a seized engine. Not solely will this assist you to hold the automobile longer, however presumably additionally retain a great resale worth.

The underside line

A automobile must be seen as a worthy asset and as such, it’s price doing the mathematics to verify your cash isn’t just flying out the exhaust. A brand new automobile is just not the monetary burden it’s made out to be whenever you do the homework and purchase responsibly.

Need to know extra about rocking your funds? Ramit’s ebook, I Will Train You To Be Wealthy, covers private finance subjects you need to know with out the uninteresting budgets and 0 lattes. Get the primary chapter without spending a dime beneath!

We’re making a gift of the primary chapter of Ramit Sethi’s New York Occasions bestseller: I Will Train You to Be Wealthy

100% privateness. No video games, no B.S., no spam. While you enroll, we’ll hold you posted

Often Requested Questions For Shopping for A New Automobile

It relies on you and what you need. It will possibly completely make sense to purchase an costly new automobile over the long run due to the whole worth idea. Save even additional on a brand new automobile by making the most of finish of the yr offers as nicely.

Sure, relying what you purchase. The whole worth of a brand new automobile might be far better than a used automobile.

A few of my favourite causes for purchasing new are: the expertise of proudly owning a model new automobile, nice mortgage offers (in case your credit score is sweet), and probably better complete worth.